How Accidents Affect Your Car Insurance Rates

Sample meta description.

Understanding the Immediate Impact of Accidents on Car Insurance Premiums

Okay, so you've been in an accident. It happens. First things first, breathe. Once you've dealt with the immediate aftermath (exchanging information, reporting the accident, etc.), you're probably wondering how this is going to affect your car insurance rates. The short answer? It usually does. But let's break down why and how much.

Insurance companies are all about risk assessment. They look at your driving history to gauge how likely you are to file a claim. An accident, especially if you're at fault, signals to them that you're a higher risk driver. Higher risk equals higher premiums. Think of it like this: they're adjusting your rate to account for the increased possibility of you needing to use their services again.

The severity of the accident plays a huge role. A fender bender in a parking lot is going to have a different impact than a major collision involving injuries. Damage amount is also key. If the repairs are minimal, the rate hike might be less significant. However, if the accident results in a total loss, expect a more substantial increase.

Factors Influencing Post-Accident Car Insurance Rate Increases: Fault, Severity, and Location

Let's dive deeper into the factors that influence how your rates will be affected. As mentioned, fault is a big one. If you're deemed at fault for the accident, your insurance company will likely raise your rates. If you're not at fault, the impact might be minimal or even nonexistent, depending on your state and insurance company policies. Some states have "no-fault" insurance systems, which can complicate things further.

Severity matters too. A minor scrape won't hurt as much as a multi-car pileup. Insurance companies look at the cost of repairs and any medical bills associated with the accident. The higher the cost, the higher the potential rate increase.

Your location also plays a part. Some states have stricter regulations regarding insurance rate increases after accidents. Also, if you live in an area with a high accident rate in general, your rates might be higher to begin with, and an accident could exacerbate the problem. Think about it – if everyone in your city is crashing into each other, the insurance company is going to want to protect itself.

Navigating the Car Insurance Claim Process After an Accident: Minimizing Rate Hike Potential

The way you handle the claim process can also influence the impact on your rates. It's crucial to report the accident to your insurance company promptly and honestly. Provide all the necessary information, but avoid admitting fault or speculating about the accident's cause. Let the insurance company conduct its investigation.

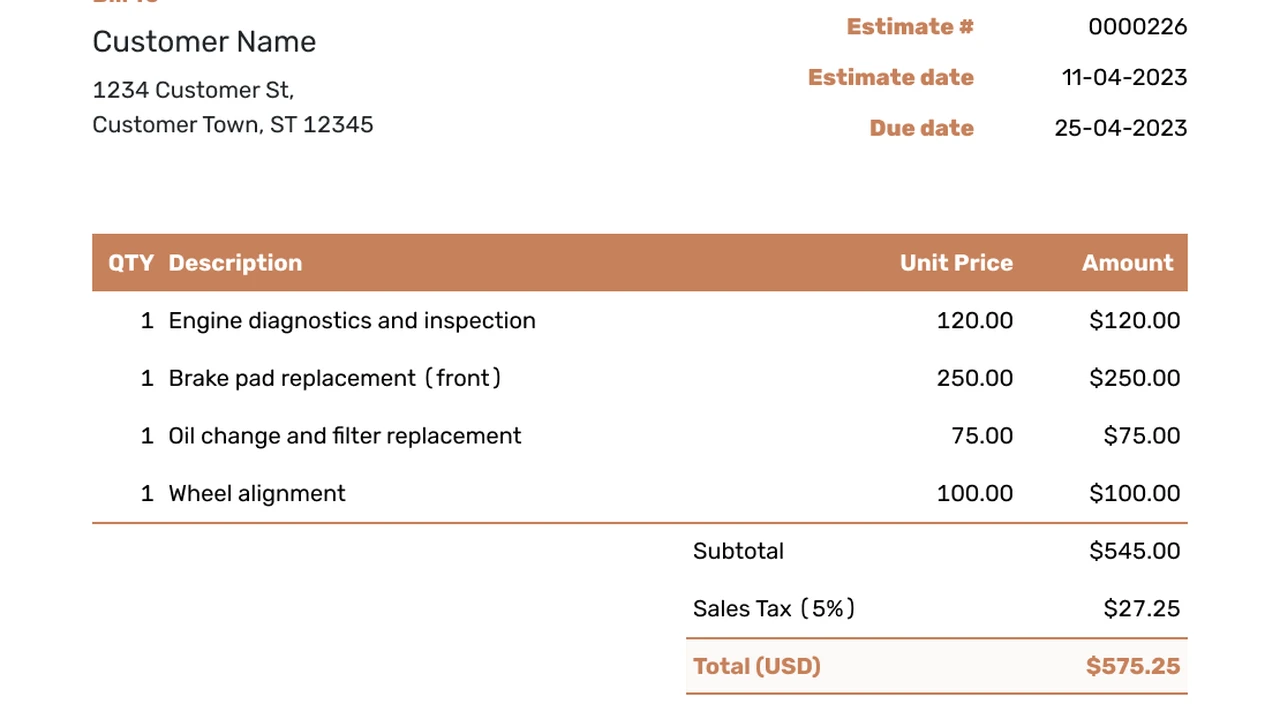

Consider whether it's even worth filing a claim for minor damage. If the repair costs are only slightly higher than your deductible, it might be better to pay out of pocket to avoid a rate increase. Do the math! Compare the cost of repairs to the potential increase in your insurance premiums over the next few years. Sometimes, paying out of pocket is the smarter financial move.

Also, be proactive in gathering evidence related to the accident. Take photos of the damage, collect witness statements, and obtain a copy of the police report. This information can help support your claim and potentially minimize your liability.

Exploring Car Insurance Options After an Accident: Shopping Around for Better Rates

Don't just accept the rate increase from your current insurance company. Shop around and compare quotes from other insurers. Insurance companies use different algorithms to calculate premiums, so you might find a better deal elsewhere. This is especially true after an accident, as some companies are more lenient than others when it comes to drivers with a recent claim.

Use online comparison tools to get quotes from multiple insurers quickly and easily. Be sure to provide accurate information about your driving history and the accident details to get the most accurate quotes. Don't be afraid to call insurance agents directly and discuss your situation. They can often provide personalized advice and help you find the best coverage at the most affordable price.

Consider increasing your deductible to lower your premiums. However, make sure you can afford to pay the higher deductible if you have another accident. It's a balancing act between saving money on your monthly premiums and being prepared for future expenses.

Car Insurance Products for High-Risk Drivers: Non-Standard Policies and Usage-Based Insurance

If you've had multiple accidents or a serious driving violation, you might be considered a high-risk driver. This can make it difficult to find affordable car insurance. In this case, you might need to consider non-standard insurance policies. These policies are designed for drivers with a poor driving record and typically come with higher premiums.

Another option is usage-based insurance (UBI), also known as pay-as-you-go insurance. These policies track your driving habits using a telematics device or a smartphone app. Your premiums are based on factors such as how often you drive, when you drive, how hard you brake, and how fast you accelerate. If you're a safe driver, UBI can help you save money on your car insurance, even after an accident. Let's look at some specific examples:

Product Recommendations and Comparisons

- Progressive Snapshot: This is a well-known UBI program. You plug a device into your car, and it monitors your driving habits. Safe drivers can earn significant discounts. Imagine you primarily drive during off-peak hours and avoid hard braking – Snapshot could significantly lower your rate. It's a good option if you're confident in your driving skills and want to prove it. The device typically ships for free, and there's no upfront cost to enroll.

- Allstate Drivewise: Similar to Snapshot, Drivewise uses a smartphone app to track your driving. It offers discounts for safe driving and provides feedback on your driving habits. A key advantage is that it can also reward you just for signing up and activating the app, even *before* it assesses your driving. This can offer immediate, albeit small, savings.

- Metromile: Unlike the others, Metromile is a pay-per-mile insurance company. You pay a base rate plus a per-mile charge. This is a great option if you don't drive much. If you primarily use public transportation or work from home, Metromile could save you a lot of money. It's best suited for low-mileage drivers. The per-mile rate varies by location and driving history, but it's typically a few cents per mile.

- The General: While not a UBI program, The General specializes in providing insurance to high-risk drivers. If you're struggling to find coverage elsewhere, The General might be a viable option. Be prepared for higher premiums, but it can provide the coverage you need.

Comparison Table:

| Product | Type | Best For | Typical Cost | Pros | Cons |

|---|---|---|---|---|---|

| Progressive Snapshot | UBI | Safe drivers who drive regularly | Discounts vary, but can be substantial | Potential for significant savings, easy to use | Requires monitoring device, potential for rate increases if you're not a safe driver |

| Allstate Drivewise | UBI | Drivers who want immediate rewards and feedback | Discounts vary, signup bonus available | Signup bonus, feedback on driving habits | Requires smartphone app, potential for rate increases if you're not a safe driver |

| Metromile | Pay-per-mile | Low-mileage drivers | Base rate + per-mile charge | Significant savings for low-mileage drivers | Not suitable for high-mileage drivers |

| The General | Non-standard | High-risk drivers | Higher premiums than standard insurance | Coverage available for high-risk drivers | Higher premiums |

Disclaimer: Prices and availability may vary. Contact the insurance companies directly for the most up-to-date information.

Defensive Driving Courses and Car Insurance Rate Reductions: A Proactive Approach

Consider taking a defensive driving course. Many insurance companies offer discounts to drivers who complete these courses. Not only can it lower your insurance rates, but it can also improve your driving skills and make you a safer driver overall. It's a win-win!

These courses typically cover topics such as safe driving techniques, traffic laws, and accident prevention. They can be taken online or in person. Check with your insurance company to see if they offer a specific list of approved courses.

Long-Term Strategies for Maintaining Affordable Car Insurance: Safe Driving and Clean Records

The best way to keep your car insurance rates low is to be a safe driver. Avoid accidents, traffic violations, and other incidents that could increase your risk profile. Maintain a clean driving record, and you'll be rewarded with lower premiums over time. Easier said than done, right? But it's the truth!

Remember, car insurance is a long-term investment. By taking proactive steps to manage your risk and shop around for the best rates, you can keep your insurance costs under control, even after an accident. Drive safe out there!

:max_bytes(150000):strip_icc()/277019-baked-pork-chops-with-cream-of-mushroom-soup-DDMFS-beauty-4x3-BG-7505-5762b731cf30447d9cbbbbbf387beafa.jpg)